FedsRetireWise

With my father – a federal government employee – approaching retirement, he saw the need for an easy-to-use retirement planning app for federal employees that also had enough assumption flexibilities to capture most revenue and expense items in retirement.

We created FedsRetireWise as a comprehensive retirement planning calculator that helps federal employees understand their sources of retirement income and whether they can cover expected expenses throughout retirement. The app provides detailed analysis of TSP withdrawals, pension benefits, and Social Security timing.

Our app is a sophisticated retirement planning tool with flexible expense and income inputs, allowing you to account for changing expenses like mortgages that end mid-retirement, additional revenue streams like rental properties, and state tax variations. It provides comprehensive scenario analyses including TSP annuity calculations and evaluation of all S&P 500 return sequences since 1926.

The app allows retirees to play with assumptions and determine whether their TSP is large enough so they can retire wisely or not! It breaks retirement into multiple periods as expenses change, calculates tax-optimized withdrawals, and shows success rates across all historical market scenarios.

For example, based on your inputs, we calculate the cost of a TSP annuity to cover your net cash needs in retirement and also show you what your TSP would do under all the 30-year S&P return sequences since 1926, including detailed year-by-year analysis and statistical summaries.

FedsRetireWise App: Helping Plan Your Federal Retirement

Are you a federal employee wondering if you can retire comfortably with your current TSP savings? Our easy-to-use retirement app aligns with the "three-layer cake" analogy used in federal retirement seminars to help federal retirees understand whether the revenue from their pensions, social security and TSP covers expected retirement expenses.

FedsRetireWise provides comprehensive analysis of whether your TSP could pay for an annuity to cover your net cash needs after including your pension and social security income. The app also runs S&P 500 return scenarios as an alternative to buying an annuity, testing your retirement plan against every 30-year period since 1926. Higher risk, but possibly higher returns for you, and maybe your children. Go to Apple app store and search for "FedsRetireWise".

Our app provides flexibility to include additional revenue sources, like a rental property, for a specific number of years and more granular expenses, like your mortgage, that may end relatively soon. The app offers complete flexibility on social security start dates (age 62, 67, or 70) and specific state income tax rates (0%, 3%, 5%, 7%, or 9%). You'll see detailed visibility into success/failure rates across all historical S&P 500 scenarios since 1926, with year-by-year breakdowns and statistical analysis showing exactly when and why scenarios succeed or fail.

FedsRetireWise App: Helping Plan Your Federal Retirement

Are you a federal employee wondering if you can retire comfortably with your current TSP savings? Our easy-to-use retirement app aligns with the "three-layer cake" analogy used in federal retirement seminars to help federal retirees understand whether the revenue from their pensions, social security and TSP covers expected retirement expenses.

FedsRetireWise provides comprehensive analysis of whether your TSP could pay for an annuity to cover your net cash needs after including your pension and social security income. The app also runs S&P 500 return scenarios as an alternative to buying an annuity, testing your retirement plan against every 30-year period since 1926. Higher risk, but possibly higher returns for you, and maybe your children. Go to Apple app store and search for "FedsRetireWise".

Our app provides flexibility to include additional revenue sources, like a rental property, for a specific number of years and more granular expenses, like your mortgage, that may end relatively soon. It also allows married federal employees to better plan their retirements with spousal benefits and income. The app offers complete flexibility on social security start dates (age 62, 67, or 70) and specific state income tax rates (0%, 3%, 5%, 7%, or 9%). You'll see detailed visibility into success/failure rates across all historical S&P 500 scenarios since 1926, with year-by-year breakdowns and statistical analysis showing exactly when and why scenarios succeed or fail.

Free RetireWise Basic App

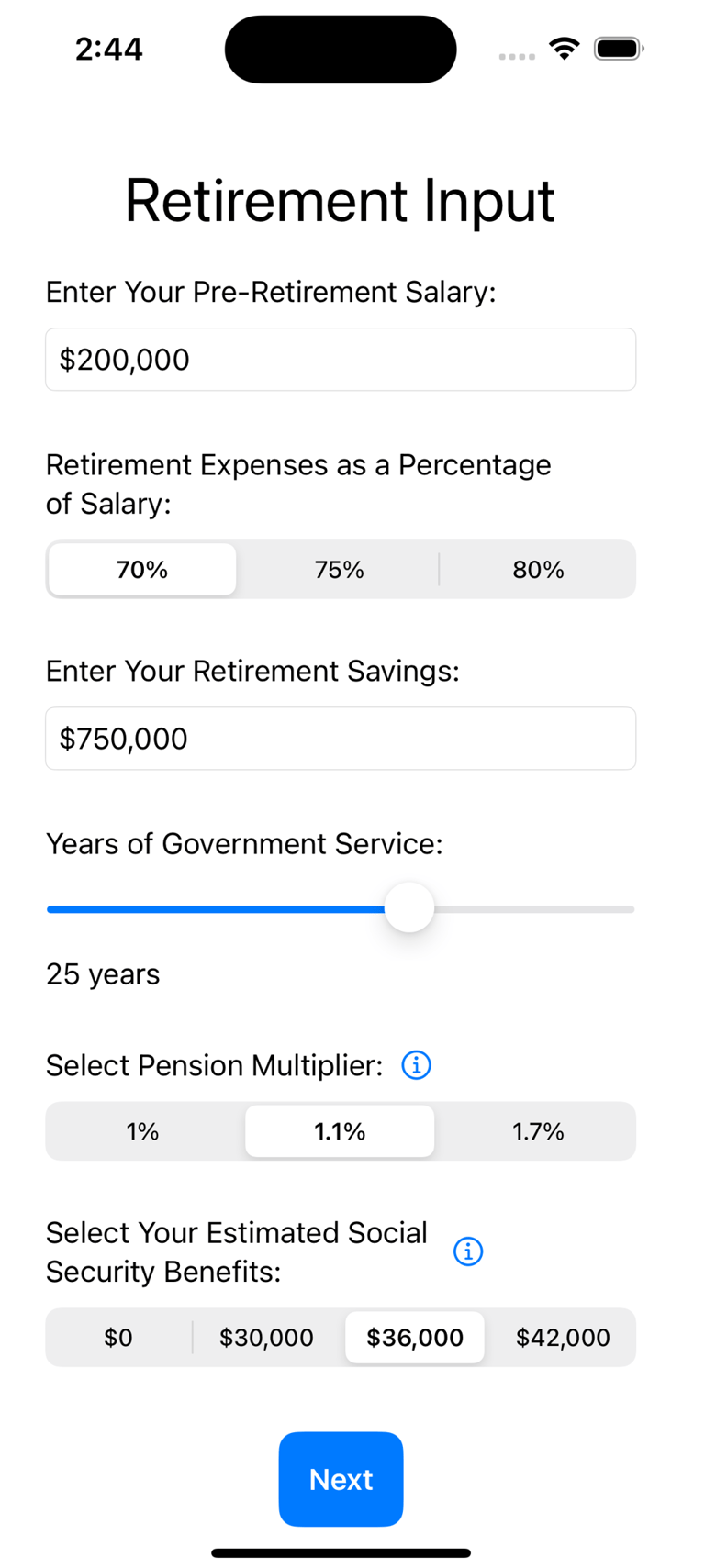

Inputs are easy, and stay on your iPhone or iPad, we do not collect this information!

See Retirement Input screen shot below. First input your expected salary at time of retirement. Second input your estimated expenses relative to your salary. Third, enter your expected TSP and/or 401K amounts as of your retirement date. Fourth enter your years of federal service and your pension multiplier. If you retire at 62, you get a 10% kicker! Lastly, enter your social security estimate based on starting at age 62, 67, or 70.

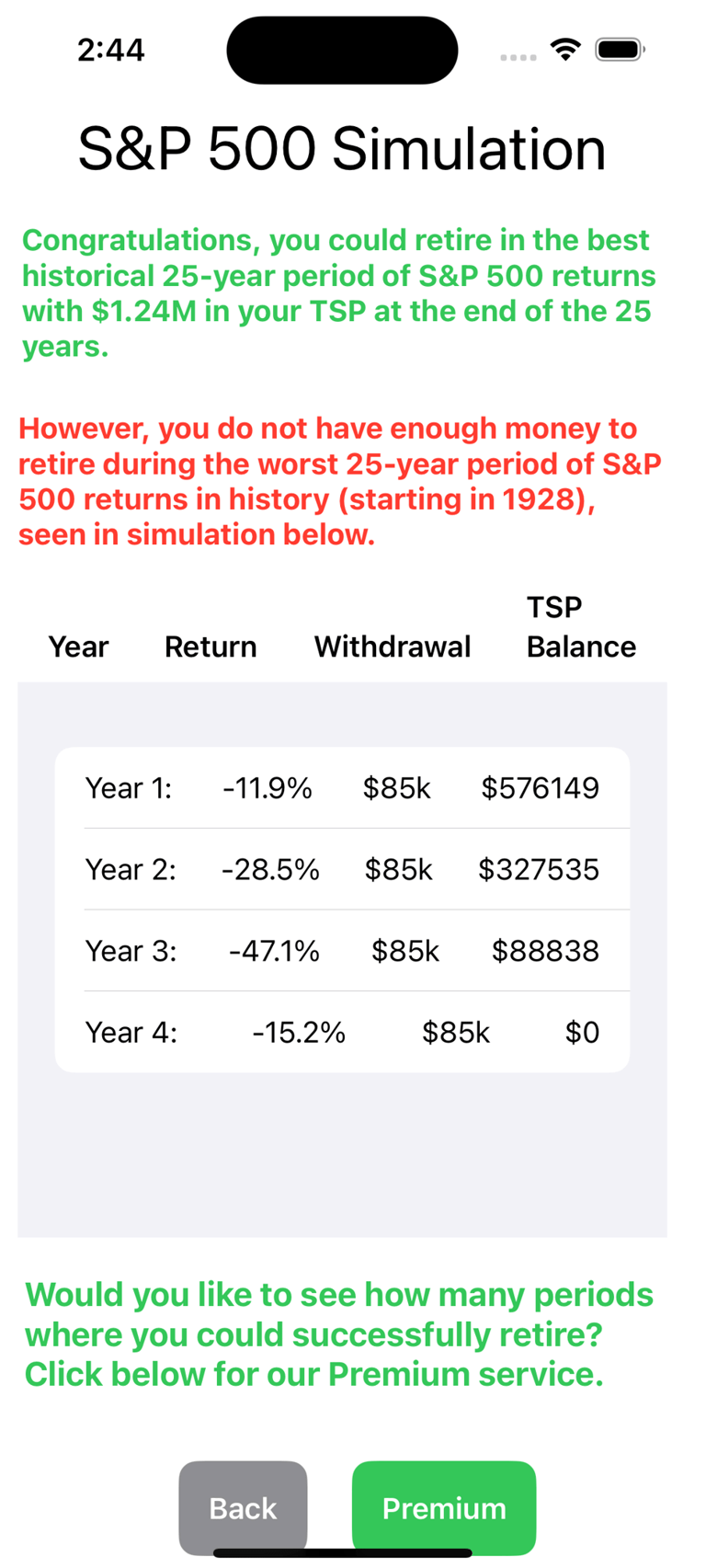

This Simulation screen helps retirees evaluate how risky a S&P 500 strategy might be for them. Since retirees will often need to use their TSP each year to pay retirement expenses, the sequence of S&P 500 returns matters! That is, you hope you have a few good years right off the bat when you retire! The good news is that the larger the TSP balance, the more volatility in returns you can survive.

This basic version shows how long your TSP would last in a depression type S&P scenario and it also shows how your TSP balance under the best 25-year scenario in past 100 years.

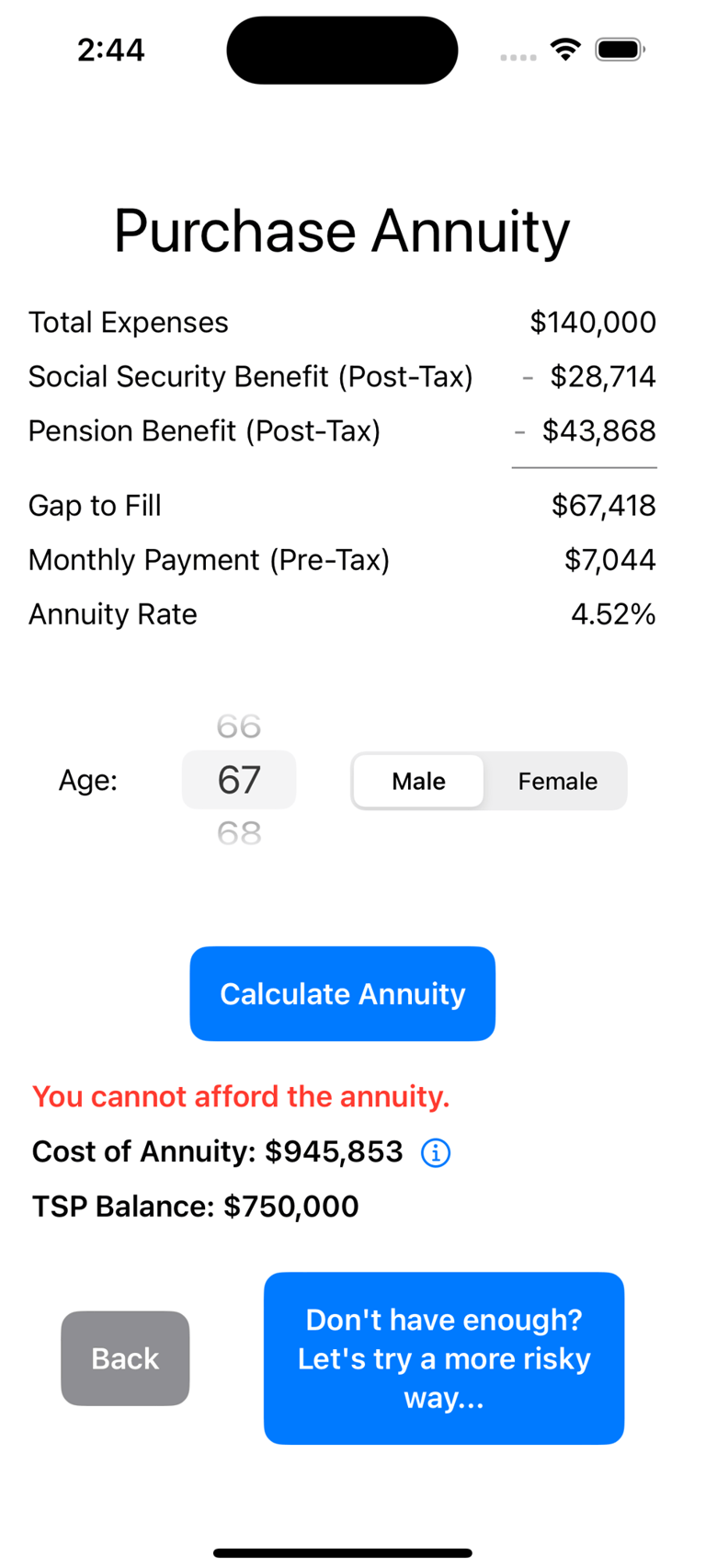

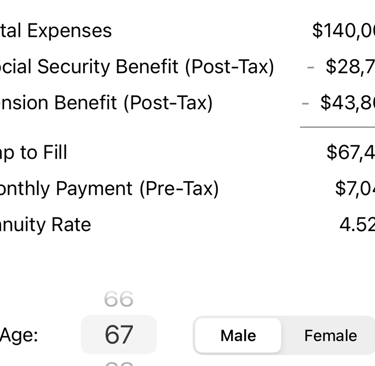

This Retirement Summary page starts off with an estimate of your annual expenses in retirement. Then we deduct Social Security payments, after-tax, and also your Pension Benefit, after-tax, to see what net cash, after-tax, you will need from your TSP to cover the remaining expenses.

We then estimate what a TSP annuity would cost to cover that amount and see if your TSP is large enough to buy the annuity. If so, you are in great shape! If not, you might want to see how a more risky, but higher return, strategy might work using historical S&P 500 returns.

FedsRetireWise: Complete Retirement Planning

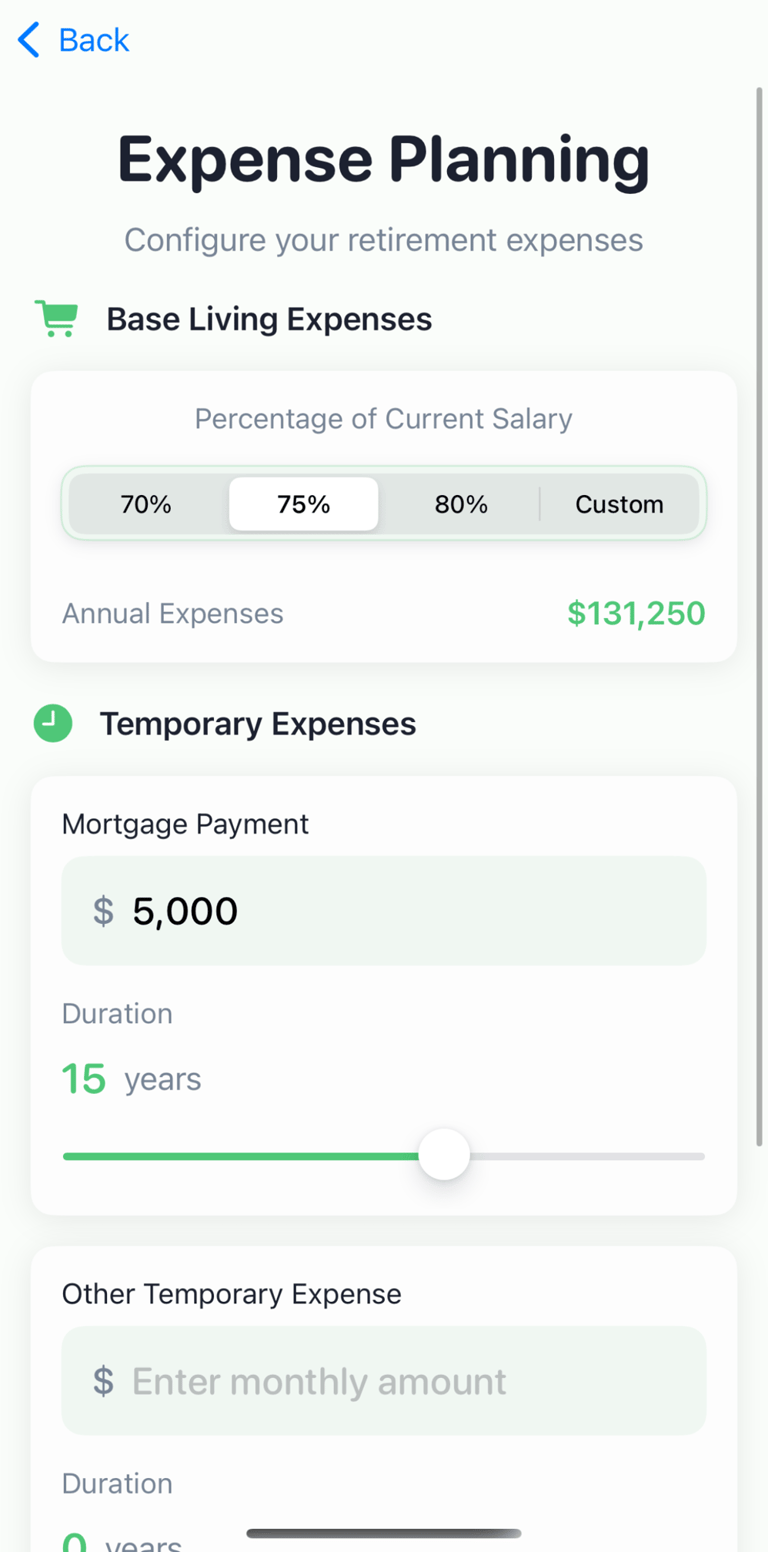

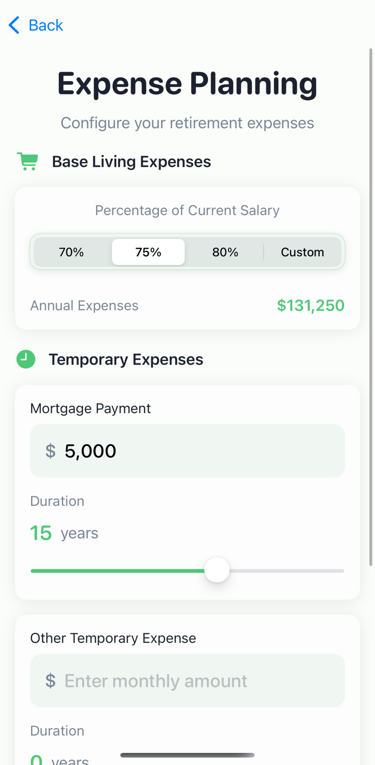

Expense Planning: Dive deeper into your retirement expenses by configuring both base living costs and temporary expenses. Select whether you'll need 70%, 75%, 80%, or a custom percentage of your current salary for retirement living.

Add temporary expenses like your mortgage payment ($5,000/month for 15 years in this example) and other time-limited costs such as college tuition or healthcare bridge coverage. The slider lets you specify exactly when each expense will end, allowing the app to automatically adjust your cash flow projections as expenses drop off during retirement. This granular control ensures your plan reflects real-life expense changes.

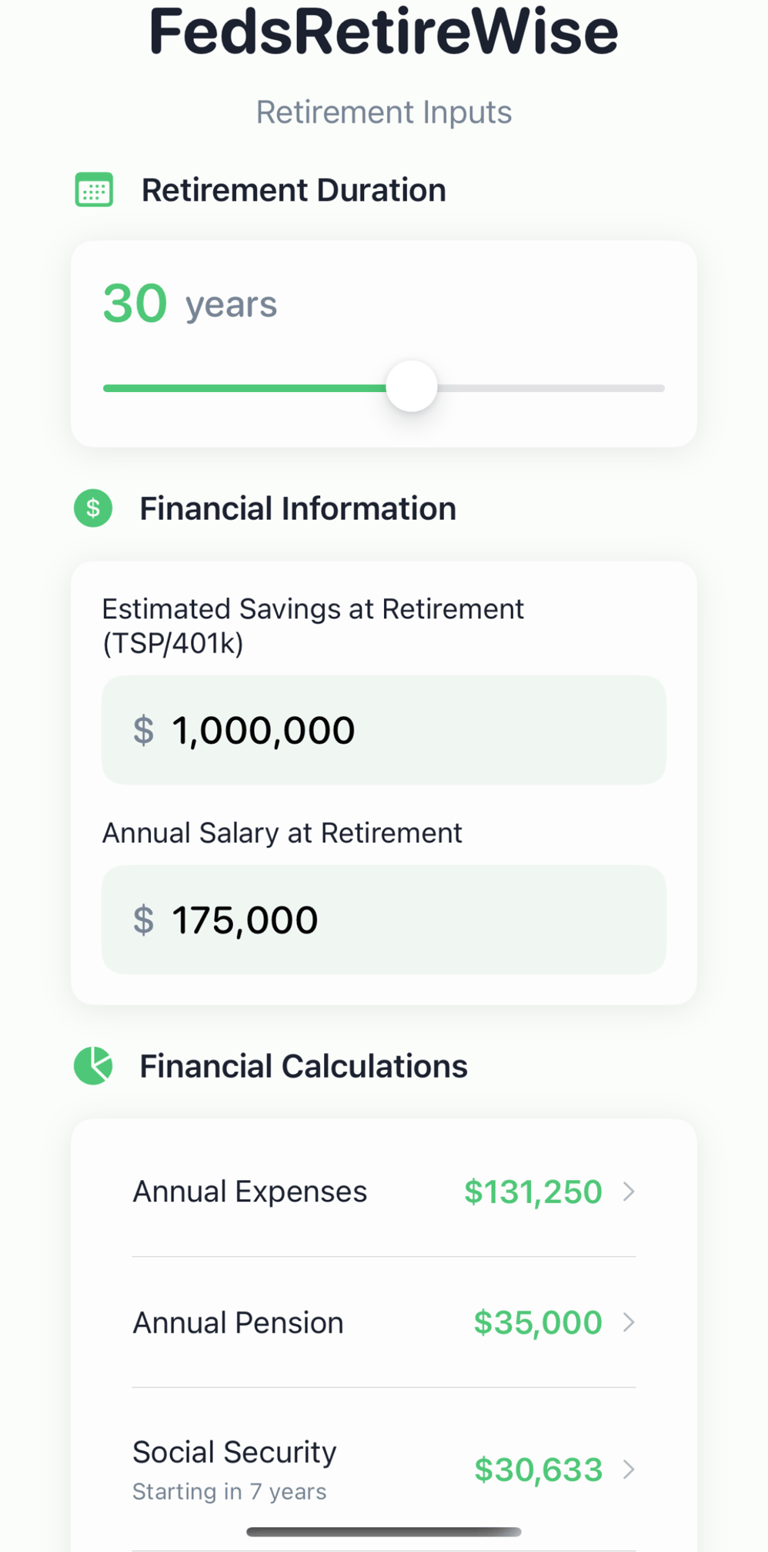

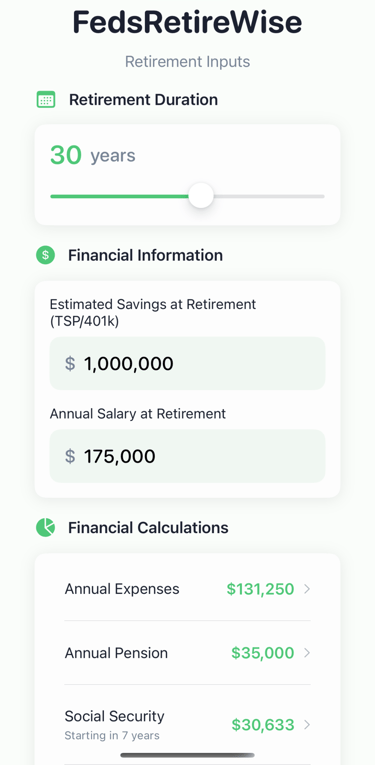

Retirement Inputs: Begin your retirement planning by entering your core financial information. Set your retirement duration using the slider (5-50 years), input your estimated TSP/401k balance at retirement, and your expected annual salary. The app immediately calculates your annual expenses, pension, and Social Security benefits based on these inputs.

Each calculation row is interactive - tap to customize details like pension multipliers, Social Security start ages, and expense percentages. This main screen serves as your dashboard, showing green values for what you'll receive and guiding you through each component of your retirement plan.

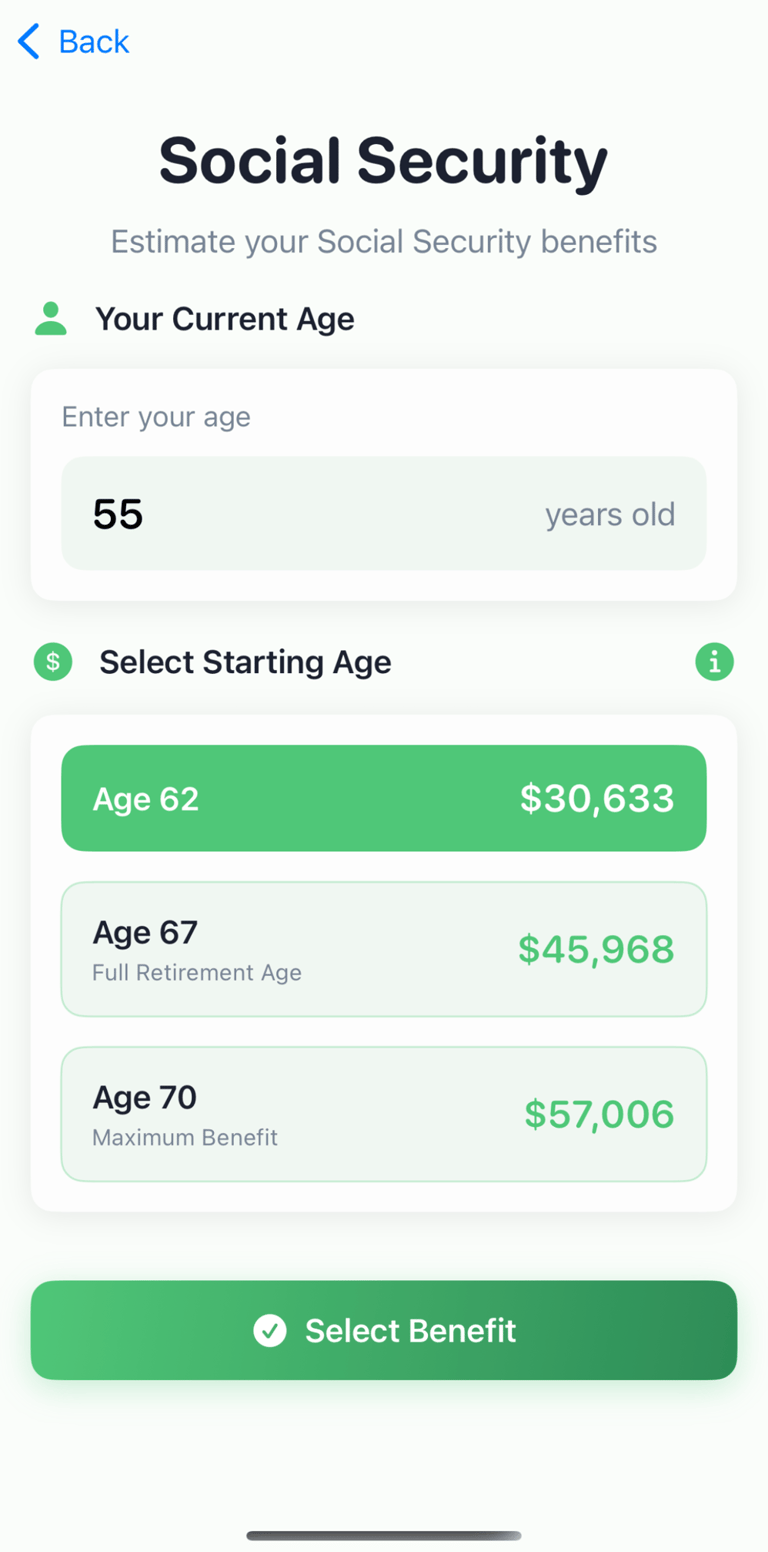

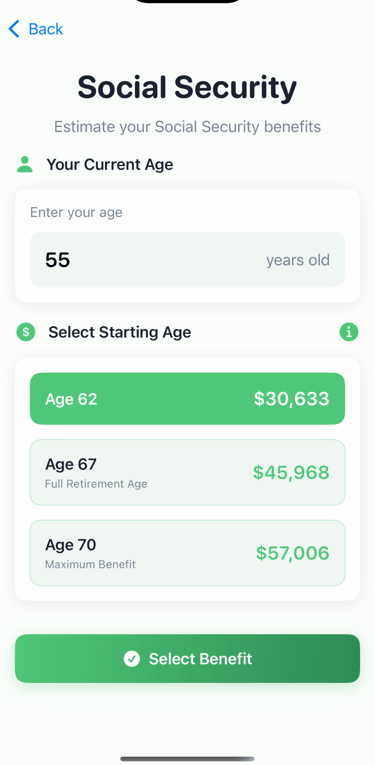

Social Security Strategy: Optimize your Social Security claiming strategy by entering your current age and comparing benefits at different start ages. The app calculates your estimated annual benefits for starting at age 62 ($30,633), full retirement age 67 ($45,968), or maximum benefit at age 70 ($57,006).

Select your preferred option with a single tap - the green highlight shows your active selection. The app automatically factors in the delay between retirement and when benefits begin, ensuring your TSP withdrawal calculations accurately reflect the years before Social Security kicks in.

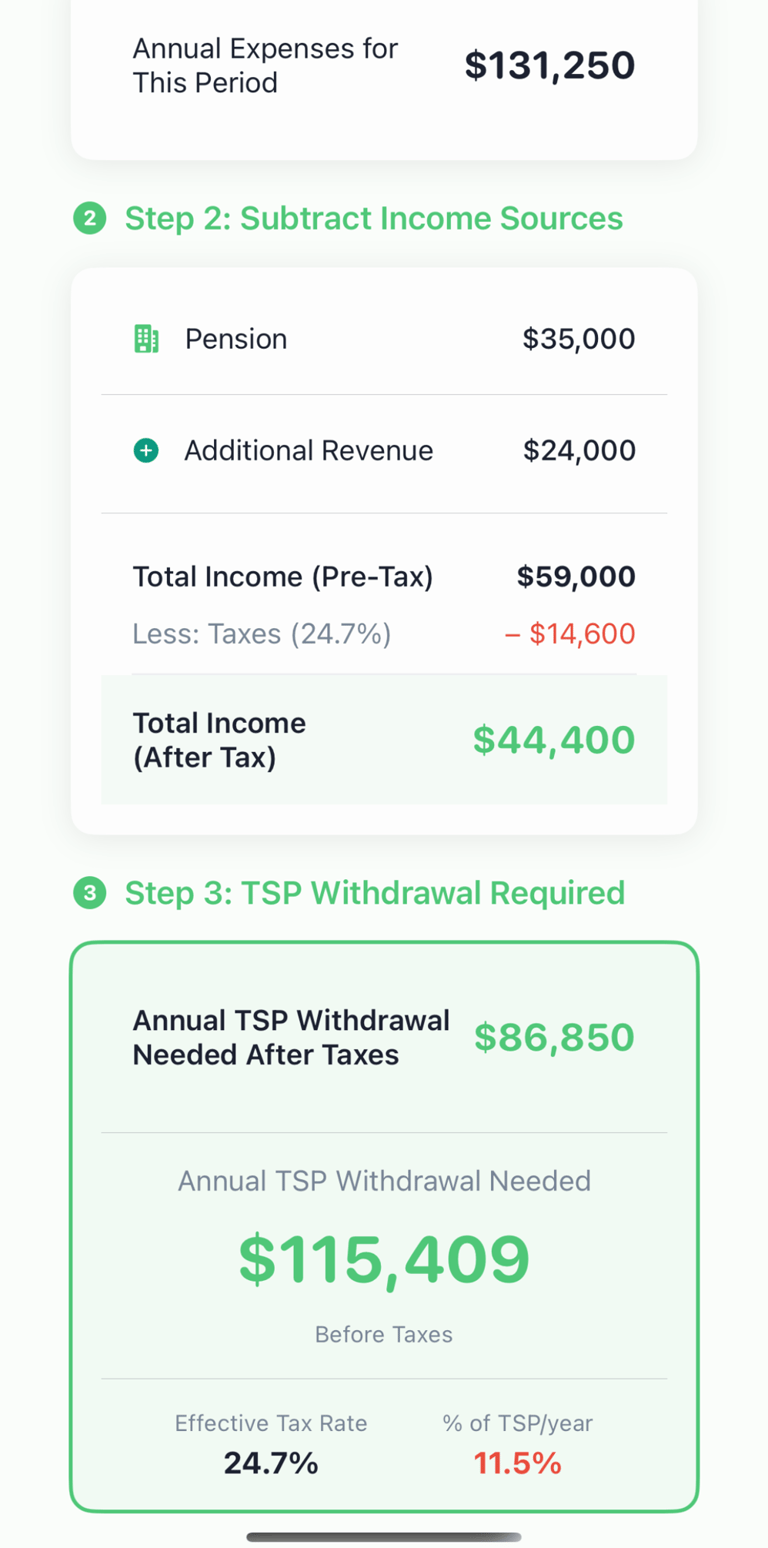

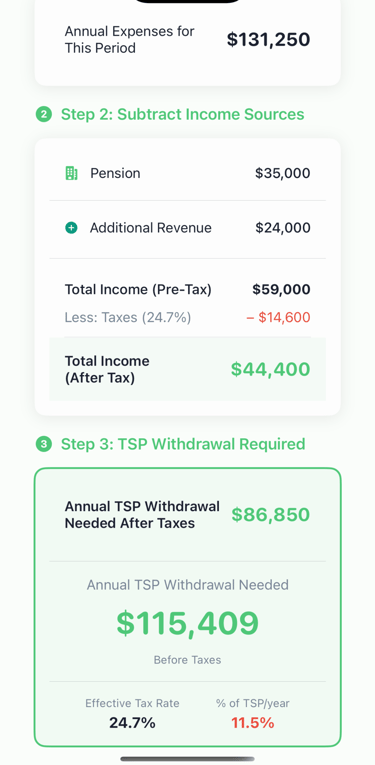

Cash Flow Analysis: View your retirement broken down into clear, step-by-step calculations. Step 1 shows your total annual expenses ($131,250). Step 2 subtracts your income sources including pension ($35,000) and additional revenue ($24,000), applying your effective tax rate of 24.7% to show after-tax income of $44,400.

Step 3 reveals the critical number: you'll need $86,850 after taxes from your TSP annually, which requires withdrawing $115,409 before taxes - representing 11.5% of your TSP balance per year. This clear breakdown helps you understand exactly where every dollar comes from and goes to.

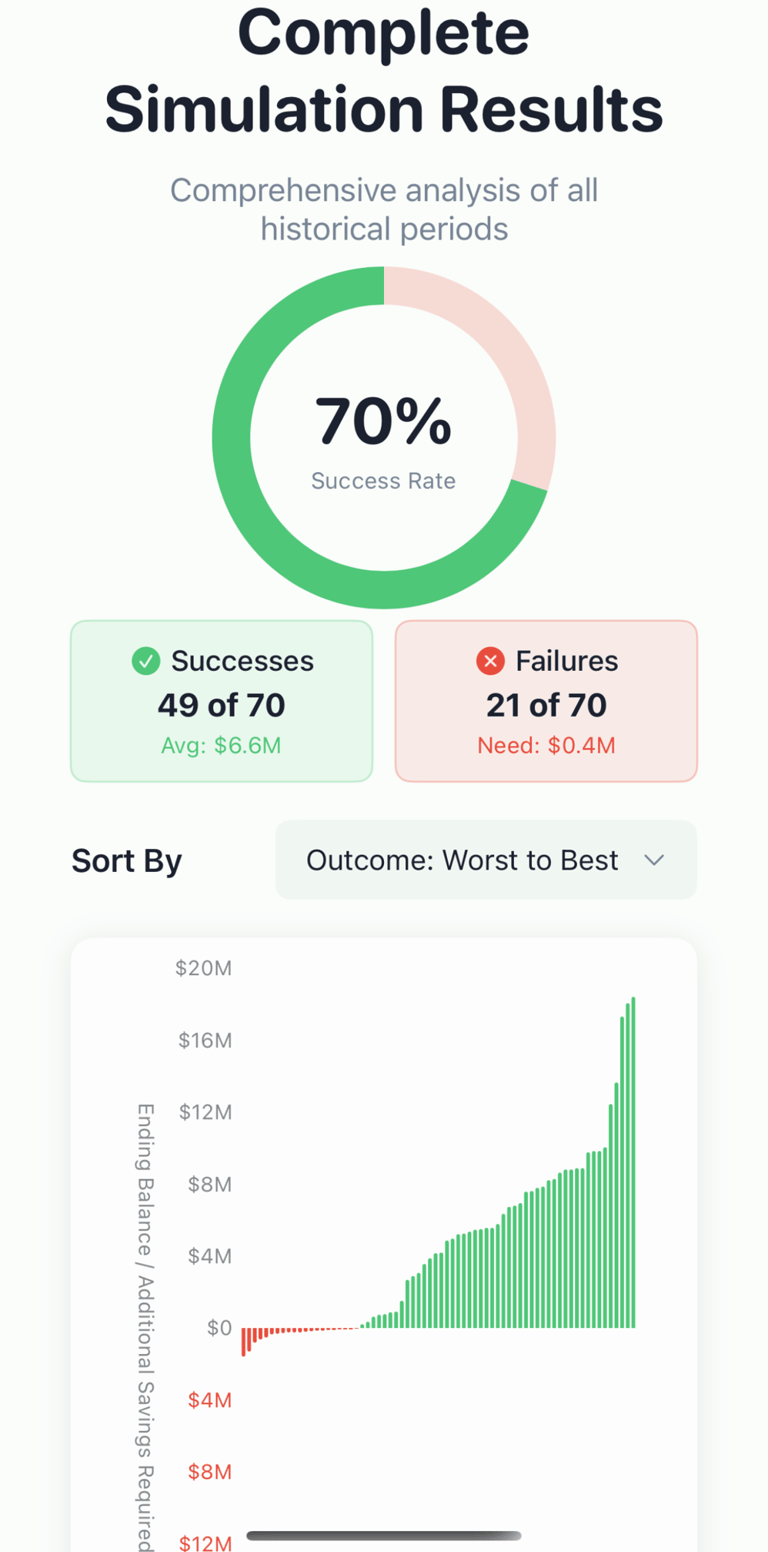

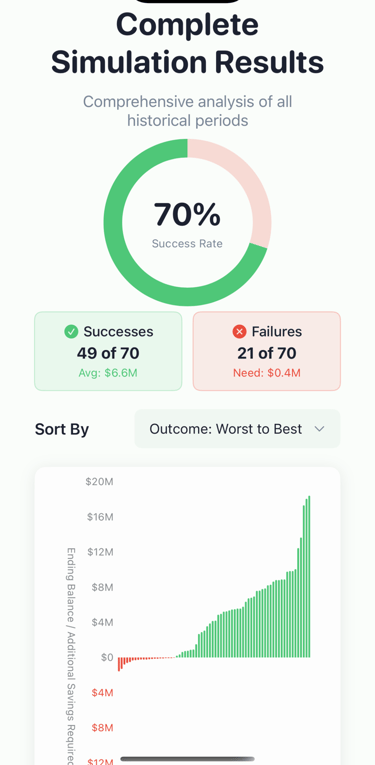

Historical Simulation Results: Test your retirement plan against every 30-year period since 1926 to see real-world outcomes. The visual pie chart immediately shows your success rate - 70% in this example (49 successes, 21 failures). Successful scenarios averaged $6.6M ending balance, while failed scenarios would have needed an additional $400K on average.

The interactive bar chart displays all periods sorted by outcome, with green bars showing ending balances for successful periods and red bars indicating shortfalls. You can sort chronologically or by performance, and tap any bar to see year-by-year details of that specific historical period, including exact returns and withdrawal amounts.

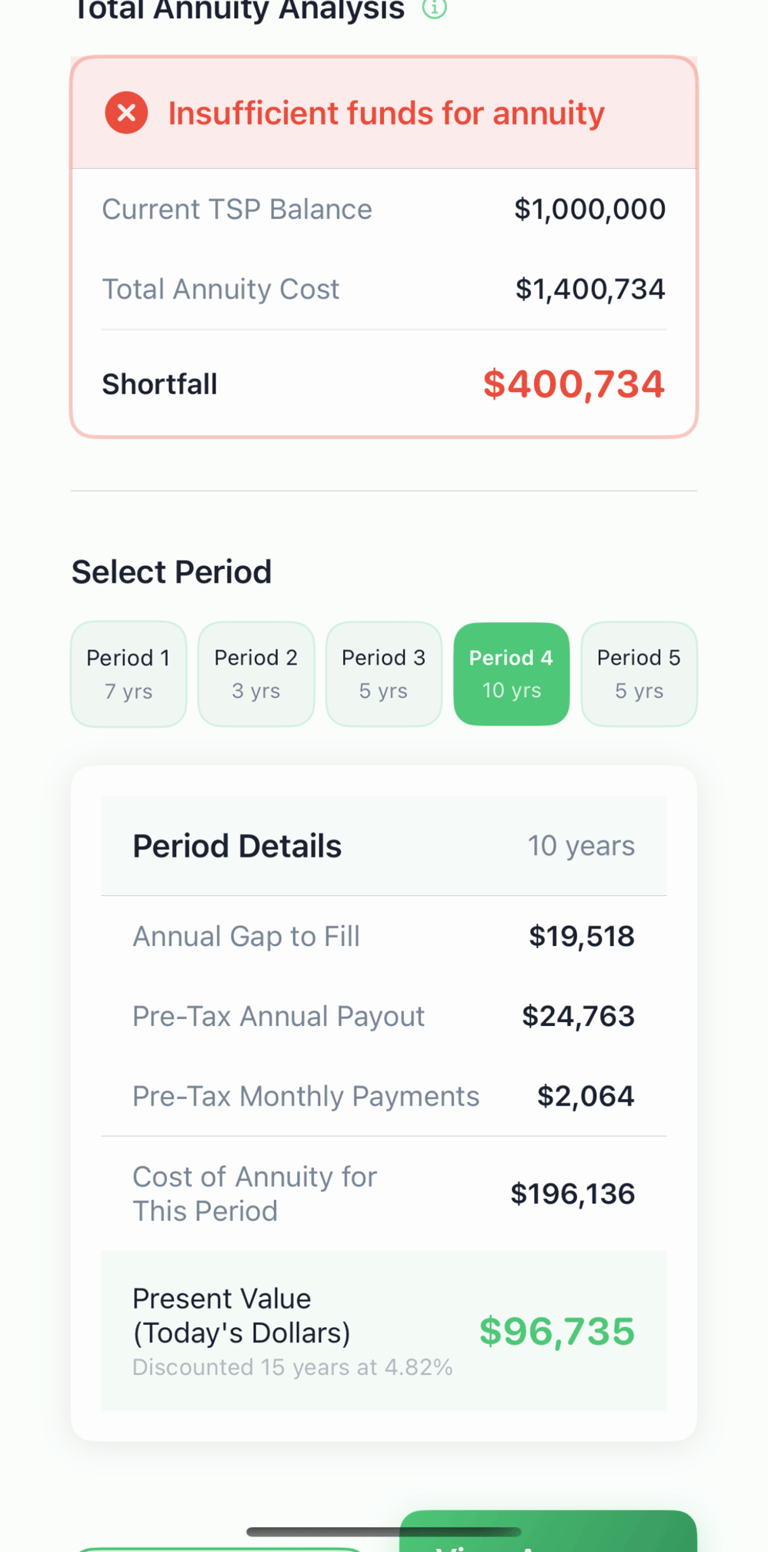

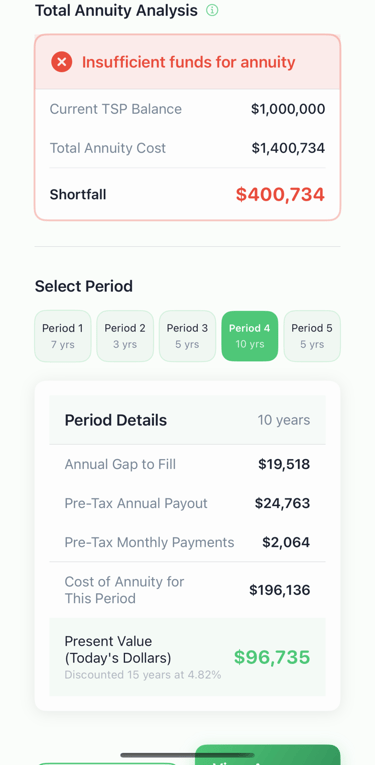

Annuity Analysis: Evaluate whether purchasing annuities to guarantee your retirement income is feasible. The app calculates that covering all your retirement periods would require $1,400,734 in annuities, but with only $1,000,000 in your TSP, you're short $400,734.

Select different periods to see detailed breakdowns - Period 4 (10 years) shows you'd need $19,518 annually after other income, requiring $2,064 monthly payments. The annuity for this period costs $196,136, but when discounted to today's dollars (15 years at 4.82%), the present value is $96,735. This analysis helps you decide between guaranteed annuity income or market-based strategies.

FedsRetireWise: Features

Tony is a Junior at the University of Notre Dame studying finance. He likes to play golf whenever he can, and understandably is a huge Fighting Irish football fan. He is actively searching for internships for summer 2026.

Inspiration

With my father – a federal government employee – approaching retirement, he was interested in learning more about the retirement finances. He had learned through classes that a general rule of thumb was that retirees should plan to pull ~4% out of their thrift savings plan each year. However, we realized that that is assuming average returns of 11% each year. While this is a good estimation, we wanted a more in depth understanding of possible returns. Through research, we learned that sequences of returns had a major effect on people's ability to retire. Therefore, we created this app with the purpose of helping federal employees understand how this may effect their finances.

About

Contact

Get in touch with us for any inquiries.

Feedback

Support

jamie.newell@fedsretirewise.com

© 2024. All rights reserved.