FedsRetireWise: Complete Retirement Planning

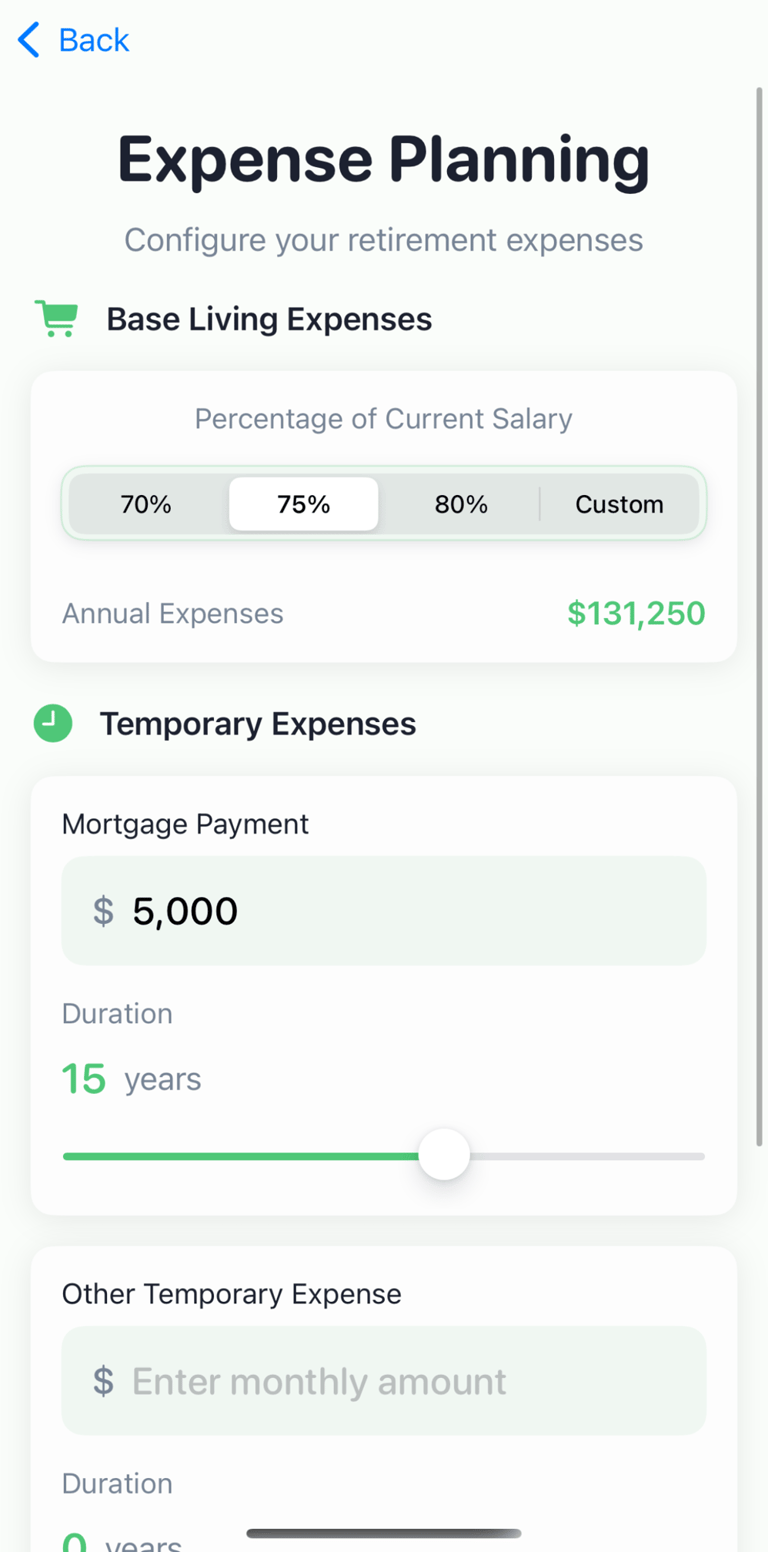

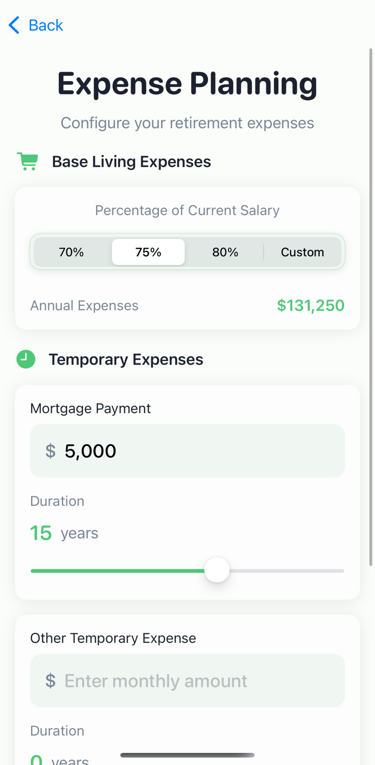

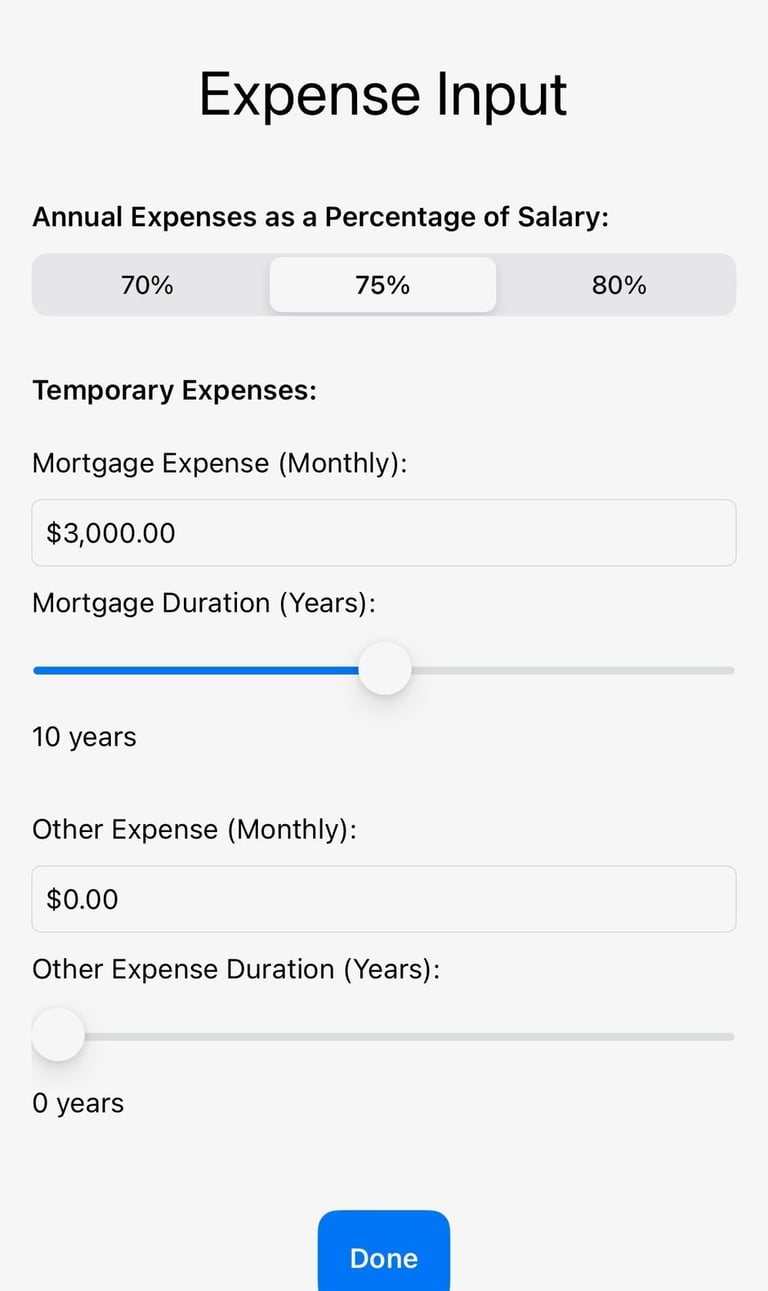

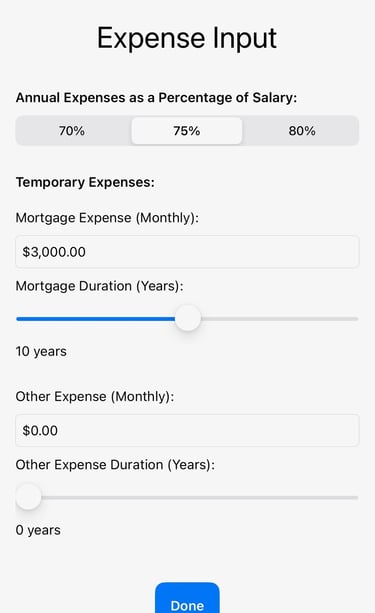

Expense Planning: Dive deeper into your retirement expenses by configuring both base living costs and temporary expenses. Select whether you'll need 70%, 75%, 80%, or a custom percentage of your current salary for retirement living. Add temporary expenses like your mortgage payment ($5,000/month for 15 years in this example) and other time-limited costs such as college tuition or healthcare bridge coverage. The slider lets you specify exactly when each expense will end, allowing the app to automatically adjust your cash flow projections as expenses drop off during retirement. This granular control ensures your plan reflects real-life expense changes.

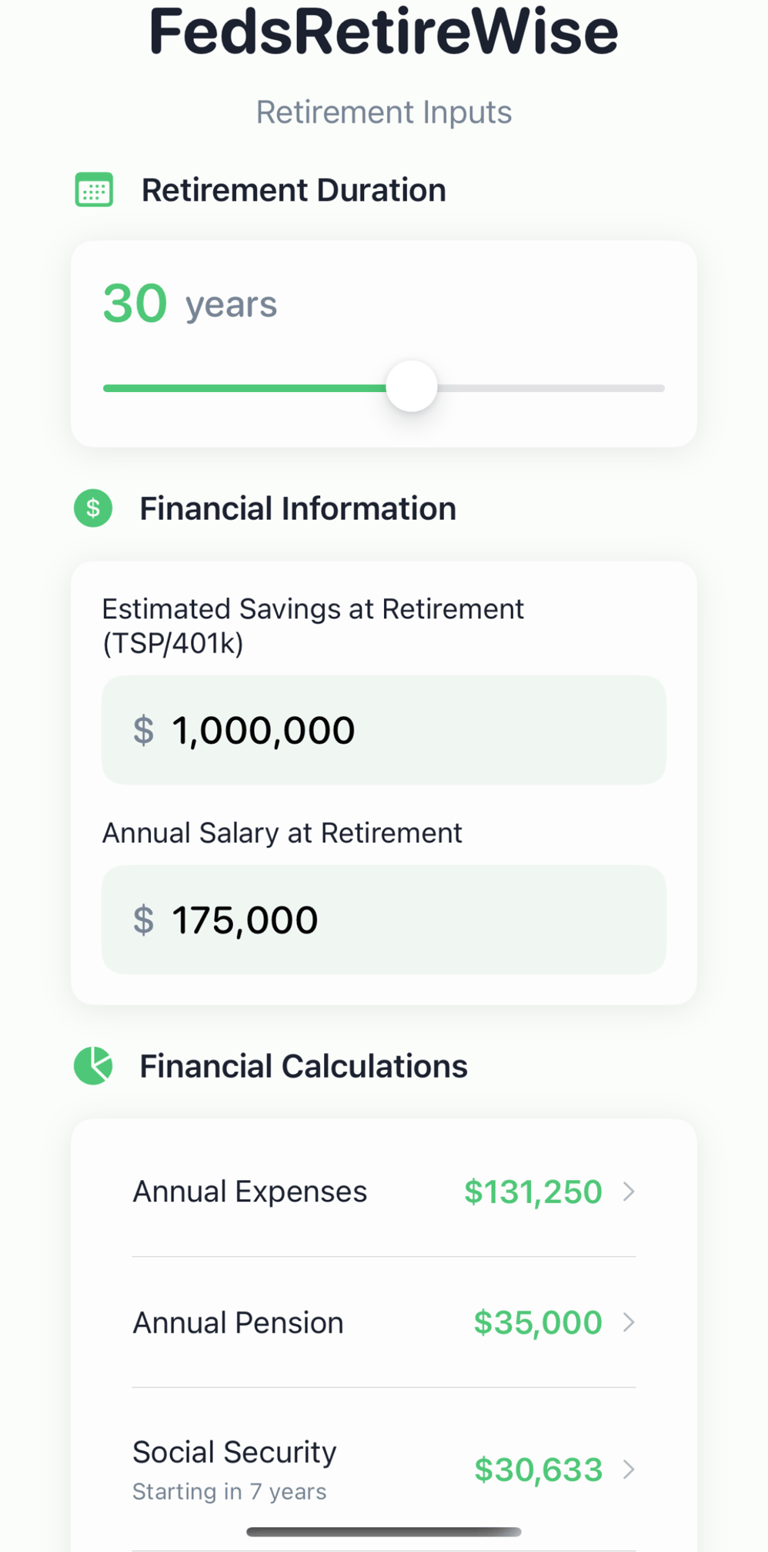

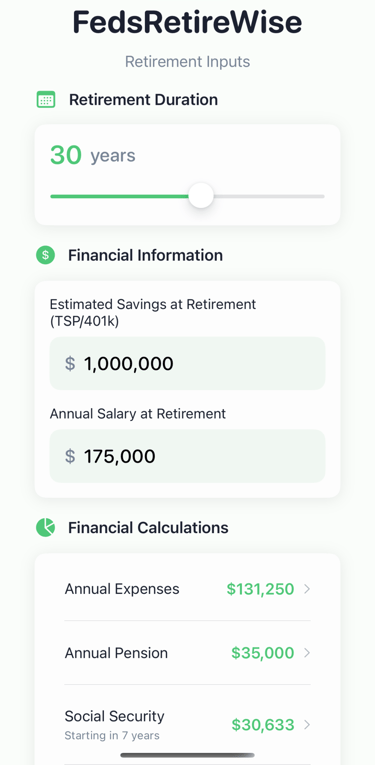

Retirement Inputs: Begin your retirement planning by entering your core financial information. Set your retirement duration using the slider (5-50 years), input your estimated TSP/401k balance at retirement, and your expected annual salary. The app immediately calculates your annual expenses, pension, and Social Security benefits based on these inputs. Each calculation row is interactive - tap to customize details like pension multipliers, Social Security start ages, and expense percentages. This main screen serves as your dashboard, showing green values for what you'll receive and guiding you through each component of your retirement plan.

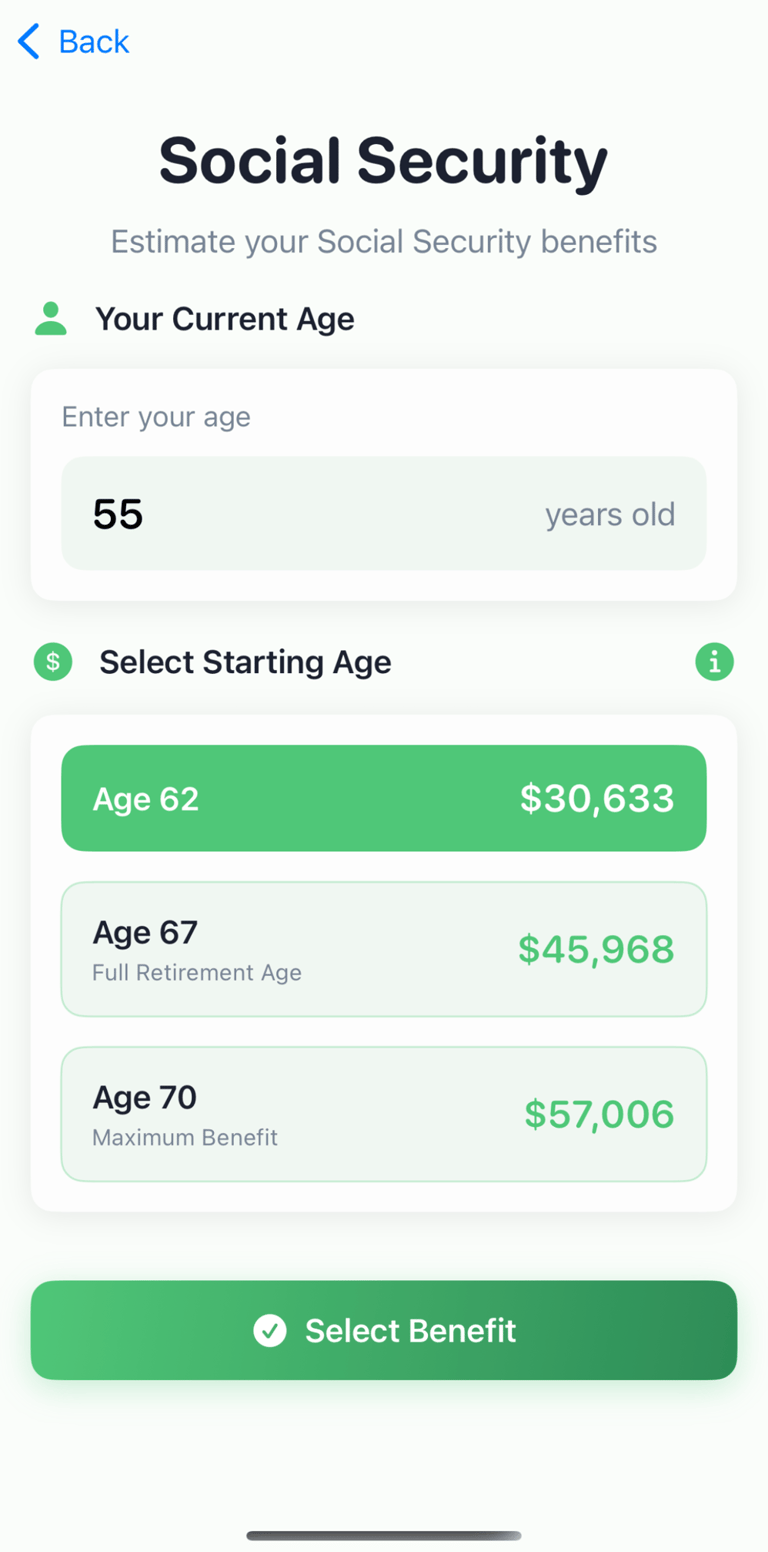

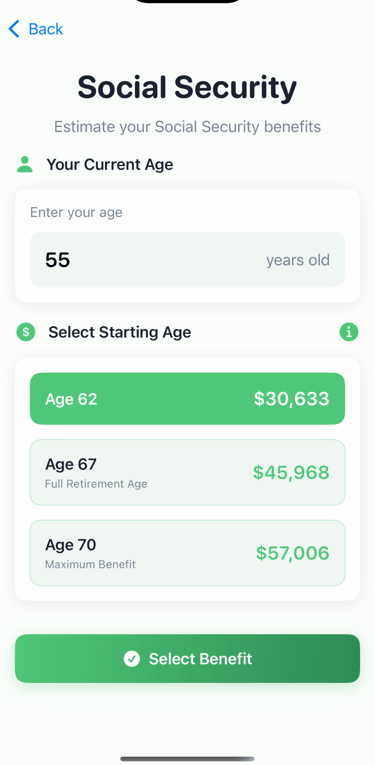

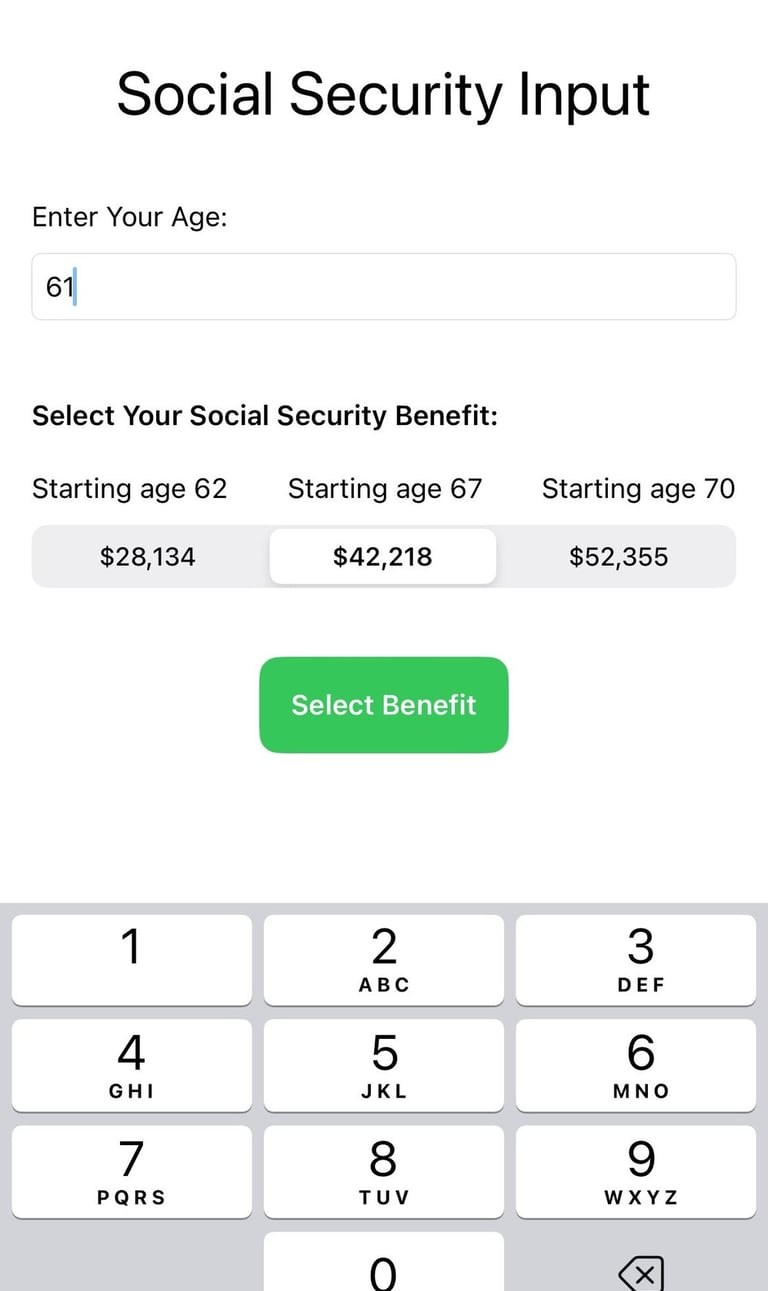

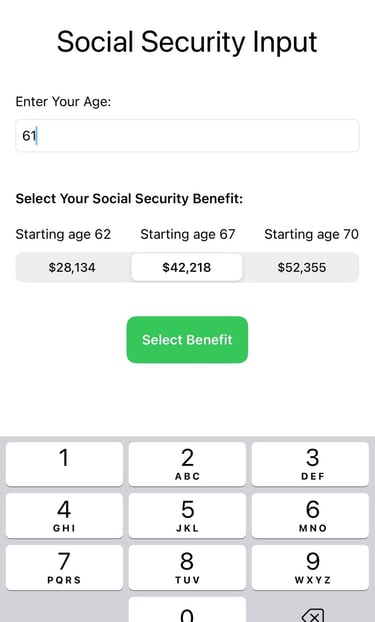

Social Security Strategy: Optimize your Social Security claiming strategy by entering your current age and comparing benefits at different start ages. The app calculates your estimated annual benefits for starting at age 62 ($30,633), full retirement age 67 ($45,968), or maximum benefit at age 70 ($57,006). Select your preferred option with a single tap - the green highlight shows your active selection. The app automatically factors in the delay between retirement and when benefits begin, ensuring your TSP withdrawal calculations accurately reflect the years before Social Security kicks in.

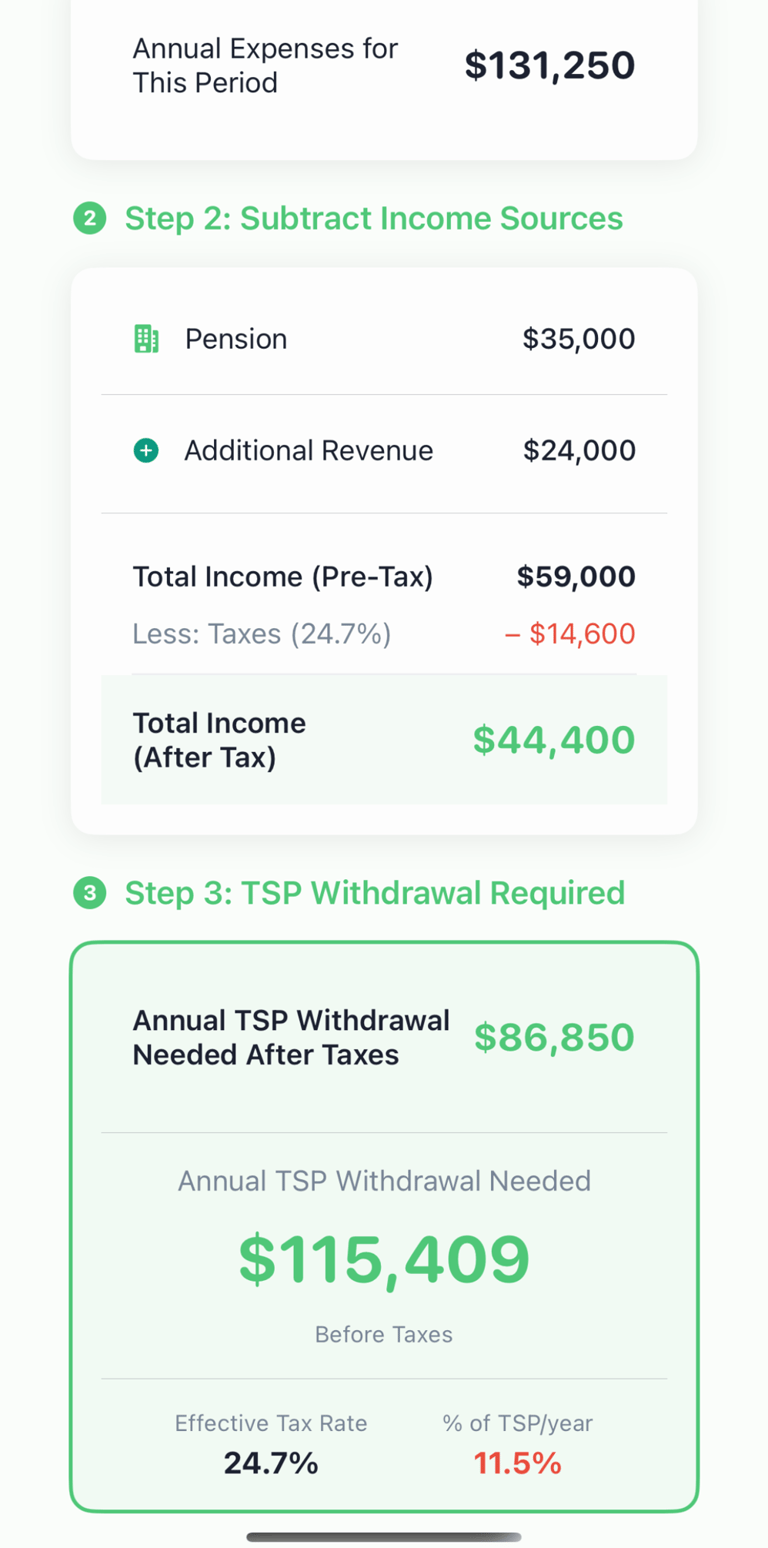

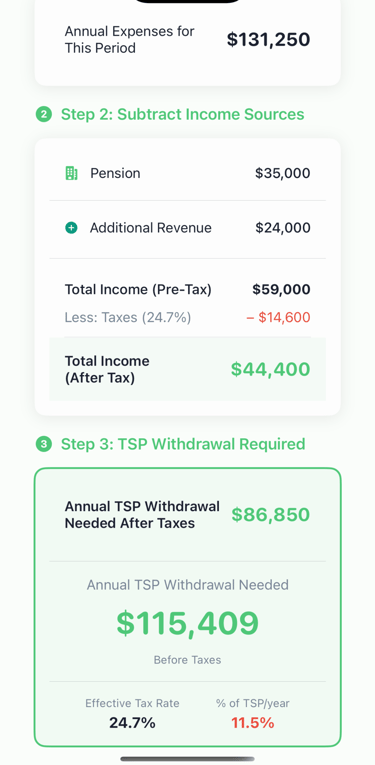

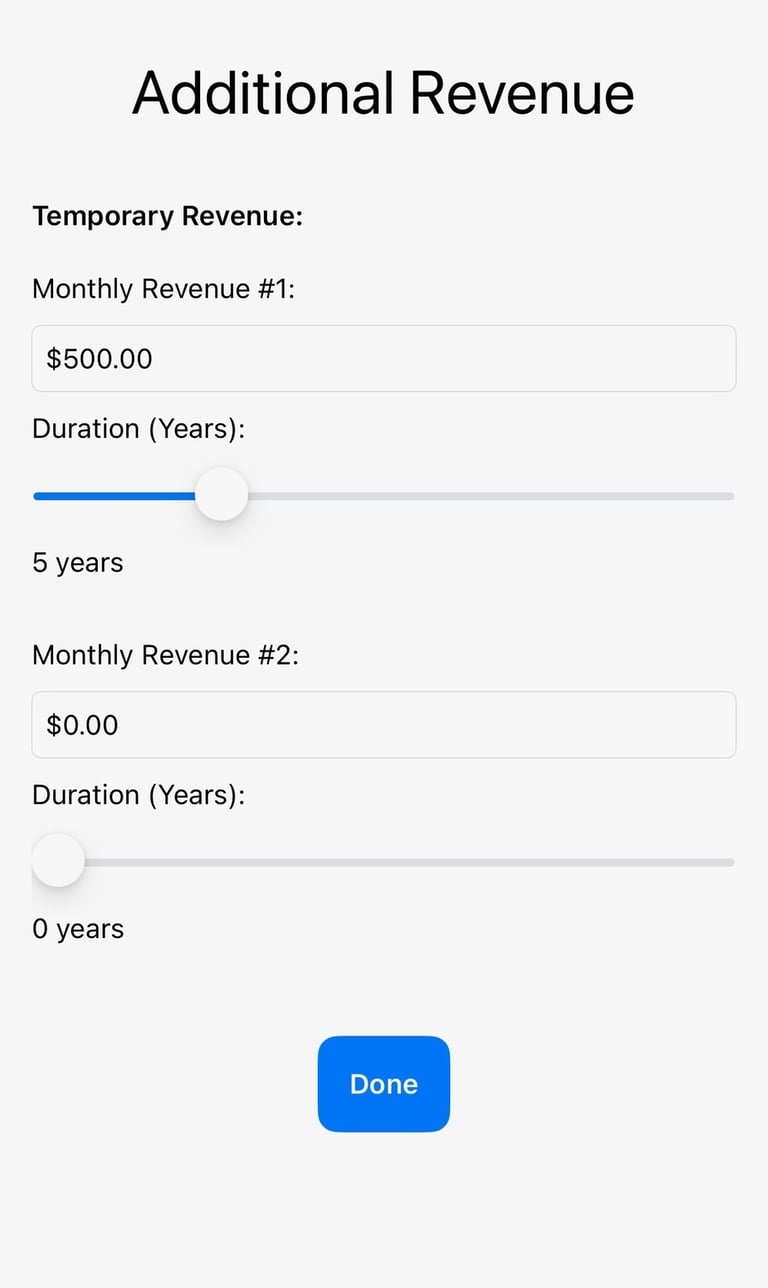

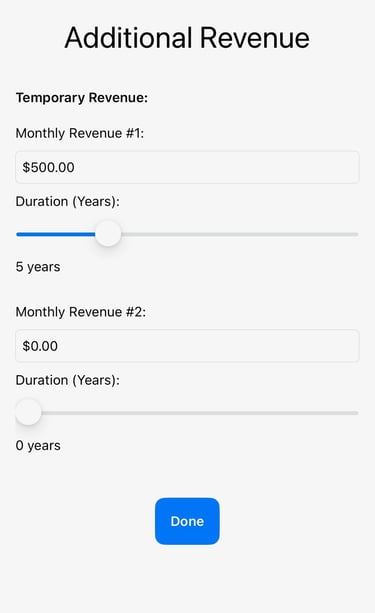

Cash Flow Analysis: View your retirement broken down into clear, step-by-step calculations. Step 1 shows your total annual expenses ($131,250). Step 2 subtracts your income sources including pension ($35,000) and additional revenue ($24,000), applying your effective tax rate of 24.7% to show after-tax income of $44,400. Step 3 reveals the critical number: you'll need $86,850 after taxes from your TSP annually, which requires withdrawing $115,409 before taxes - representing 11.5% of your TSP balance per year. This clear breakdown helps you understand exactly where every dollar comes from and goes to.

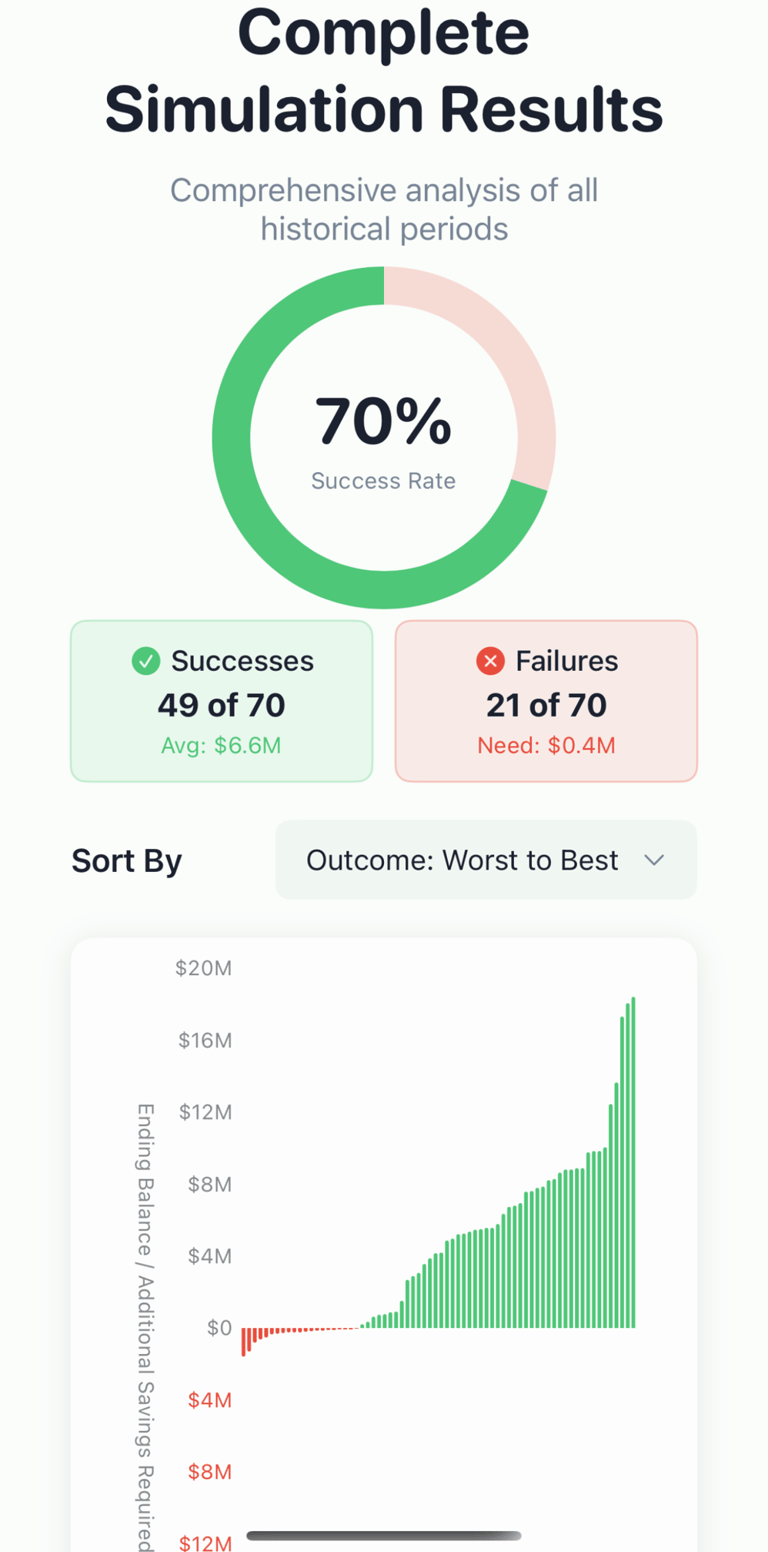

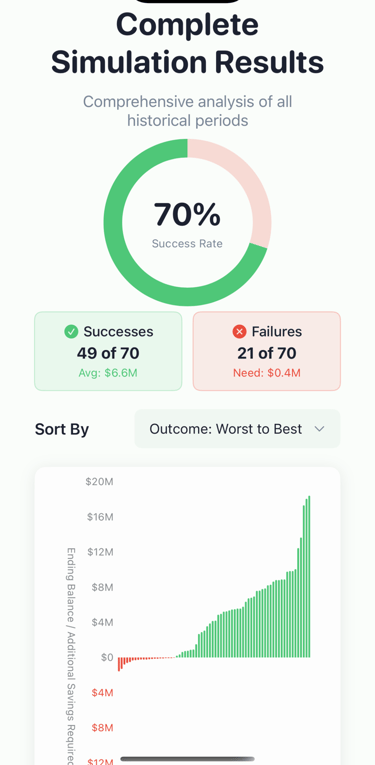

Historical Simulation Results: Test your retirement plan against every 30-year period since 1926 to see real-world outcomes. The visual pie chart immediately shows your success rate - 70% in this example (49 successes, 21 failures). Successful scenarios averaged $6.6M ending balance, while failed scenarios would have needed an additional $400K on average. The interactive bar chart displays all periods sorted by outcome, with green bars showing ending balances for successful periods and red bars indicating shortfalls. You can sort chronologically or by performance, and tap any bar to see year-by-year details of that specific historical period, including exact returns and withdrawal amounts.

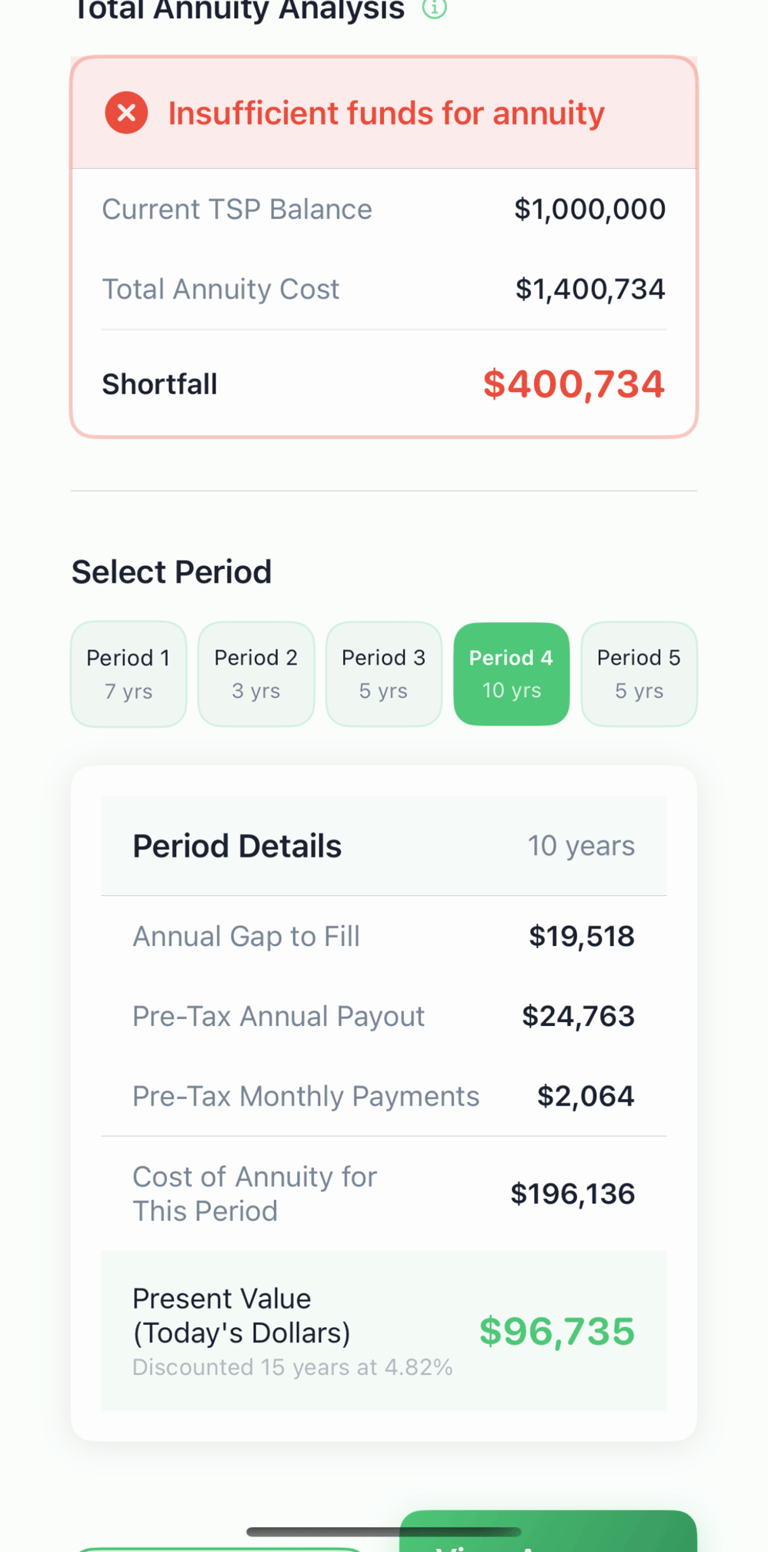

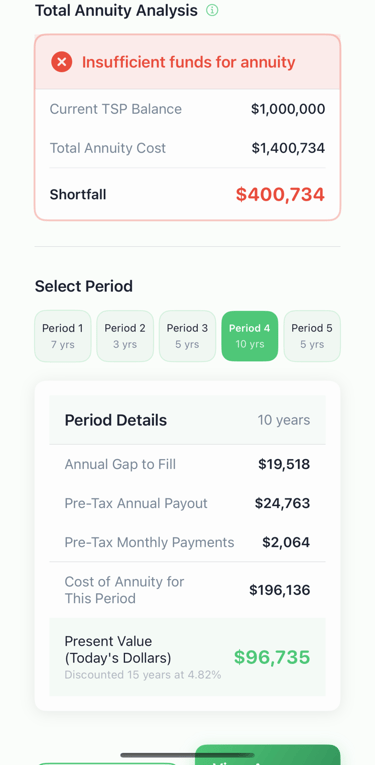

Annuity Analysis: Evaluate whether purchasing annuities to guarantee your retirement income is feasible. The app calculates that covering all your retirement periods would require $1,400,734 in annuities, but with only $1,000,000 in your TSP, you're short $400,734. Select different periods to see detailed breakdowns - Period 4 (10 years) shows you'd need $19,518 annually after other income, requiring $2,064 monthly payments. The annuity for this period costs $196,136, but when discounted to today's dollars (15 years at 4.82%), the present value is $96,735. This analysis helps you decide between guaranteed annuity income or market-based strategies.

FedsRetireWise: Features

Additional Benefits

Provide a general summary of the services you provide, highlighting key features and benefits for potential clients.

Detailed Expenses

• Model how changes in expenses, like your mortgage, will impact your retirement savings over time, enabling informed decisions about spending and budgeting.

Additional Revenue

• Account for various sources of additional income, including part-time work, rental income, or side businesses, for a more accurate picture of retirement income.

• Adjust additional revenue streams to see how changes in income affect your retirement savings.

• Explore strategies to maximize your Social Security benefits, such as delaying retirement or optimizing claiming strategies.

• Understand the impact of Social Security on your overall retirement income to make informed decisions about when and how to claim benefits.

Customizable Social Security

Contact

Get in touch with us for any inquiries.

Feedback

Support

jamie.newell@fedsretirewise.com

© 2024. All rights reserved.